Overview

As the demand for sustainable water management grows, water companies are turning to smart metering technology to improve efficiency, reduce waste and enhance customer service.

Not only does smart metering offer increased operational efficiency for water providers, but it also represents a crucial step in creating more sustainable water management systems and addressing rising concerns over water scarcity, making it an unsurprising focus for industry regulator Ofwat.

Ofwat’s 2023 announcement of the ‘Water Efficiency Fund’ (WEF) is accelerating the industry’s transition to smart metering, with many water companies eager to take advantage of the incentives offered for implementing a smart metering programme.

However, the challenges in delivering a successful smart metering programme are known to both Ofwat and water companies, with the energy sector’s earlier move to mandatory smart metering serving as a helpful guide for the water industry as it embarks on this transition.

What is evident is that multi-disciplinary expertise across the water and IT sectors is required to successfully deliver a smart metering programme and that experienced commercial and legal procurement specialists are needed to ensure water companies gain access the best market offerings.

Lessons from the energy sector

In September 2024, Ofwat published a report on the key lessons from the energy sector smart meter rollout: Learning from experience: what the rollout of smart metering in energy sector can teach us about smart metering in water.

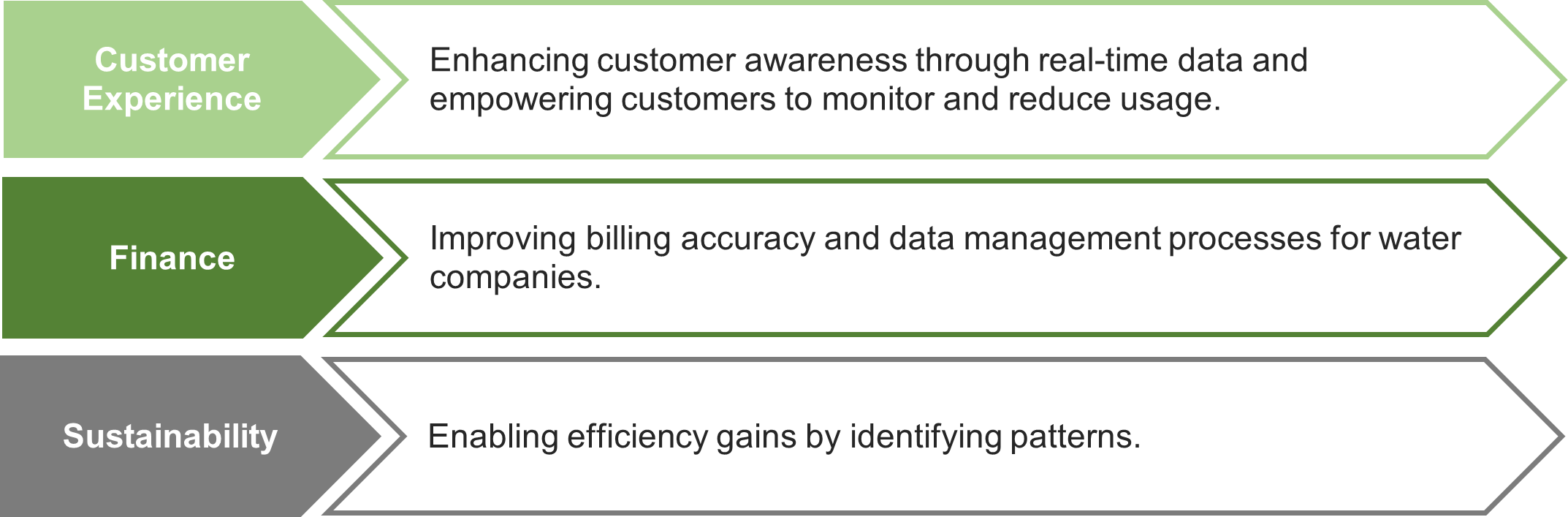

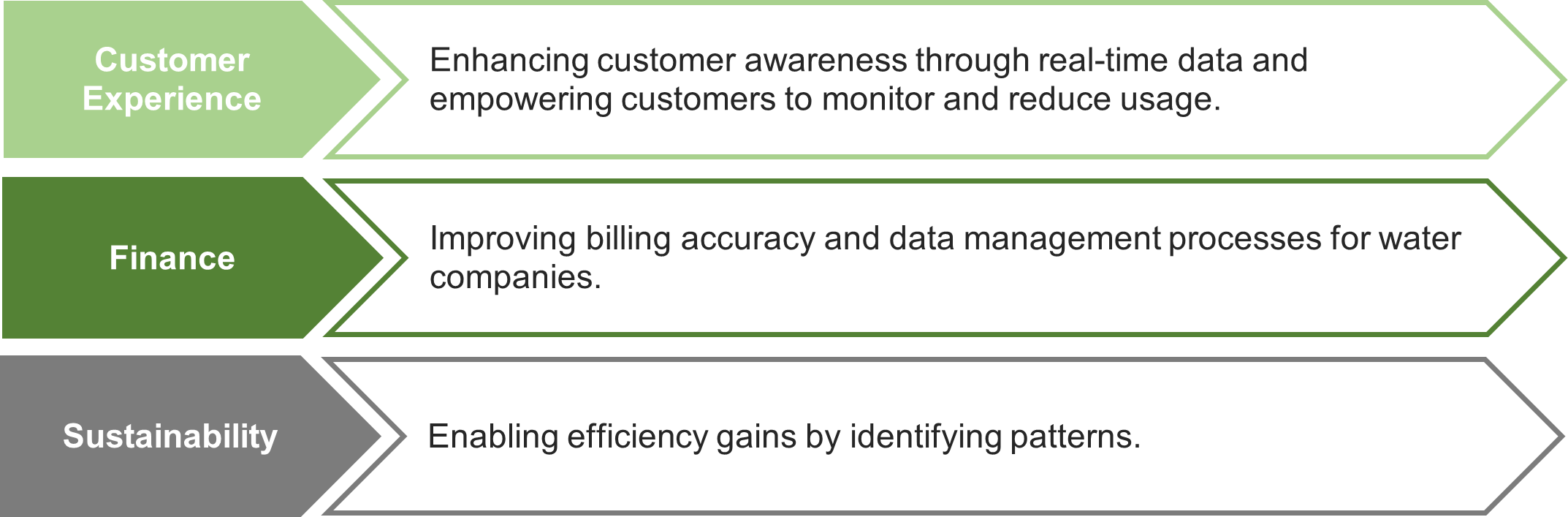

The report highlights the smart metering benefits experienced by the energy sector, including:

Equally, the challenges faced by the energy industry were also explored. Among other things, Ofwat identified the additional demand placed on utility providers for increased data management and robust IT governance systems, as well as changing public perspectives around privacy and scepticism.

Most importantly, the report acknowledged that high implementation costs exceeded initial estimates. This outcome is likely to be compounded by the less unified approach to smart metering that is being undertaken by the water industry with each company undertaking its own procurement processes.

Implementation considerations for water companies

While the adoption of smart metering technology offers significant operational benefits, water companies must carefully consider the commercial, legal and technological implications in undertaking such a large transformation project.

A successful smart metering rollout requires a comprehensive strategy that balances technology integration, regulatory compliance and effective supplier relationships.

Highlighted below are several key considerations for water companies that are looking to undertake a smart metering transformation project, including the necessary infrastructure, network and data decisions to be considered prior to commencing any procurement activity.

Packaging the smart metering solution

One of the first decisions water companies face is how to package the smart water metering solution for procurement and delivery purposes.

Typically, a smart metering solution includes three main components, which water companies can choose to procure separately or bundle them together into a single package.

| Smart Meter Devices |

Installation Works |

Smart Network |

| Supply of smart meter devices produced by a device manufacturer capable of transmitting data readings at a specified frequency |

Installation of Smart Meter Devices at properties within the water companies licensed operating area, including any civil works and works on household and non-household properties to install, maintain and repair smart meter devices |

Establishment of a smart network for the frequent transmission of data from smart devices to the water companies new or existing IT architecture including development of API or systems integration services

|

Each option presents its own advantages and challenges, such as:

- Supplier capabilities: It’s essential to assess the capabilities of suppliers in the market. Water companies should understand the strengths and weaknesses of potential partners, ensuring they select suppliers that provide the best value for money, performance, and service. Bundling the components can help drive competition, potentially lowering costs and improving service delivery.

- Interface management and risk: During both the delivery and operational phases, managing the interfaces between the meter supplier, installation contractor, and network provider is critical. Effective coordination is essential to avoid delays or operational failures. This complexity increases the risk, making careful interface management crucial to ensuring smooth operations.

- Contract complexity and management: The way the smart metering solution is packaged will significantly impact contract management. Separate contracts may introduce additional administrative burden, as each interface must be managed closely across multiple suppliers. Alternatively, bundling contracts may simplify coordination but could increase dependence on a few suppliers, which brings its own set of risks. A balanced approach is needed to minimise administrative complexity while mitigating supplier risks.

- Pricing: The pricing structure of the metering solution must be evaluated carefully. Packaging components together may offer economies of scale and cost savings. However, separate contracts can offer more flexibility to negotiate specialised rates with suppliers, who may not need to factor in higher supply chain overheads for package areas outside their own expertise. Water companies must assess the long-term operational savings alongside any short-term pricing advantages to find the best value for money.

- Timing: Timely completion of each project phase, installation of meters, setup of the network, and operational readiness, is vital to the success of the smart metering program. Delays at any stage can disrupt service, incur additional costs, and damage customer trust. Careful management of timelines and supplier coordination is crucial to ensuring that milestones are met on schedule.

Preparing the contract and service requirements

The form of the contract should be aligned with the chosen packaging strategy.

Each component of the solution (device supply, installation, and network provision) has unique requirements and service expectations that are usually found in different types of contracts.

While there is of course some common ground, the key risks addressed in a works contract are, for example, different to those identified in an IT contract.

Where the components are procured separately, water companies may engage suppliers under the following separate contracts (some or all of these components may be combined into single contract depending on the chosen packaging strategy):

| Component |

Key Terms |

| Supply of smart meter devices |

Devices may be purchased directly from a manufacturer or re-seller under a supply contract which promises product availability, outlines delivery lead times and agrees pricing for new and replacement parts.

This contract should also contain clear product specifications and warranties, including a warranty in respect of battery life and agreed usage parameters. |

| Installation works |

Given the nature of the installation works, a standard form construction contract (for example, NEC) may be most suitable for the meter installation services.

The important contractual terms here relate to site preparation and safety, ways of working, obtaining necessary permits and compliance with regulatory requirements for civil works. It is important also to consider any dependencies the installation contractor will have on the Smart Network provider and vice versa. |

| Smart network |

This contract will relate to the establishment and maintenance of the smart network, including the design and development of any API or systems integration services required to interface the smart meter devices with a water company’s existing IT environment.

As well as requiring on-going DaaS services for the provision of meter reading data, this contract will need to include appropriate terms around cyber security, data protection and software licensing. As meter reading data is personal data for the purposes of UK GDPR, water companies will need to be mindful of supplier data processing arrangements.

Technical expertise is required to ensure the stated service requirements and any performance indicators align with the water company’s needs and expectations. |

Input from experienced stakeholders during development of each of the above contracts is key to ensuring that a water company achieves overall project success and longevity, as well as ensuring that the water company is best placed when approaching the market for possible solutions.

This approach will also require on-going and careful contract management from water companies to effectively manage contract interface risk and ensure proper collaboration between separate suppliers.

For water companies that elect to package all or any of the above components, a bespoke contract will be necessary to consolidate the above key terms into a single agreement and set out clear management requirements for the appointed supplier’s oversight of complex relationships between subcontractors. Clear delivery timelines and performance standards, as well as risk allocation terms are key legal priorities in such an arrangement.

Whether or not a package solution can be obtained will depend largely on supplier capabilities and market offerings. Water companies may look to adopt a more complex procurement strategy and process to ensure they have all the information needed to confidently appoint a single delivery partner and to enable negotiation opportunities with potential suppliers.

Performance commitment deadlines

A key consideration for water companies in deciding when to undertake a smart metering roll-out is the application of performance commitment deadlines (“PCDs”) by Ofwat.

Given the importance and financial implications of not achieving PCDs, water companies undertaking smart metering programmes will be reliant on strong supplier relationships and good contract management to achieve their stated deployment and delivery targets.

To mitigate the financial risks associated with these commitments, water companies should explore their contractual options for recovering associated losses from their supply chain partners, as well as considering contractual mechanisms to incentivise suppliers to meet deadlines and performance standards, ensuring the project stays on track.

Such mechanisms could include the incorporation of a milestone regime, application of liquidated damages in the event of delays, an on-going service level agreement and strict performance monitoring and reporting requirements.

Take aways

Successfully implementing a smart metering programme in the water sector requires careful planning, technical expertise, and a strong understanding of the commercial and legal practicalities and implications.

Water companies must work with experienced professionals who can navigate the complexities associated with a smart meter roll-out, IT systems integration and regulatory compliance.

By taking a strategic, well-coordinated approach and addressing key legal considerations, water companies can ensure a smooth and efficient rollout, enhancing both operational performance and sustainability.

Sharpe Pritchard is a trusted legal advisor to the public and utilities sectors. For specialist advice in relation to smart metering in the water sector, please contact Allan Owen, Partner or Charlotte Smith.