This article explains the tax context, the practical implications and key issues to address when implementing or modifying arrangements.

Background

Historically, HMRC treated local authority leisure services as business activities for VAT purposes, on the basis that authorities were not acting as public authorities when providing such services.

In 2022, following litigation brought by Local Authorities from across the UK, the Upper Tribunal (Tax and Chancery Chamber) considered whether leisure services fall within article 13 of the Principal VAT Directive (Directive 2006/112/EC) as activities carried out under a “special legal regime,” such that the authority is not a taxable person unless non-taxable treatment would distort competition.

Under Article 13, there were two conditions that needed to be fulfilled in respect of the activities:

(1) The activities had to be carried out by a body ‘governed by public law’; and

(2) the activities carried out by that body had to be ‘activities… in which they engage as public authorities’.

In the lead case in England (HMRC v Chelmsford City Council [2022] UKUT 00149 (TCC)) both HMRC and CCC did not dispute that the first test was met, but HMRC did not agree that that the First Tier Tribunal’s conclusion that s19 of the Local Government (Miscellaneous Provisions) Act 1976 was the source of the power to undertake the activity in question and, therefore, was the ‘applicable legal regime’.

The UT agreed with the Local Authorities and following a detailed review, HMRC accepted that allowing local authorities to treat their leisure services as non-business would not significantly affect competition and changed the VAT treatment such services as set out in Revenue and Customs Brief 3 (2023).

What does this mean?

Before 2023, Local Authorities that provided in-house leisure services to members of the public treated these supplier as “business activities” and either charged standard rated VAT to customers or sought to apply an exemption.

Now, Local Authorities can treat the leisure services as “non-business activities” and therefore they do not need to charge Output VAT.

Further, Local Authorities can claim back from HMRC the overpaid Output VAT they had previously accounted for to HMRC meaning potential cash benefits, with the added bonus of being able to backdate claims for up to four years.

Key VAT concepts

Business/Economic activity

VAT is chargeable to business (economic) activities, not to non-business activities. HMRC applies the test in Wakefield College [2018] BVC 22 as detailed in Revenue and Customs Brief 10 (2022)[1] to determine whether an activity is business in nature.

Stage 1: the activity results in a supply of goods or services for consideration

This requires the existence of a legal relationship between the supplier and the recipient. An activity that does not involve the making of supplies for consideration cannot be business activity for VAT purposes.

The Court of Appeal in Wakefield emphasised that a ‘supply for consideration’ is a necessary condition but not a sufficient condition for an ‘economic activity’.

Stage 2: The supply is made for the purpose of obtaining income therefrom (remuneration)

Where there is a direct or sufficient ‘link’ between the supplies made and the payments given, the activity is regarded as economic. The Court in Wakefield College [2018] made a distinction between consideration and remuneration. Simply because a payment is received for a service provided does not itself mean that the activity is economic. For an activity to be regarded as economic it must be carried out for the purpose of obtaining income (remuneration) even if the charge is below cost.

Input and Output VAT

Output VAT is the VAT that’s due on a seller’s taxable supply. Input VAT is the VAT that is charged on a business’s purchases and expenses, such as goods and services supplied to the business.

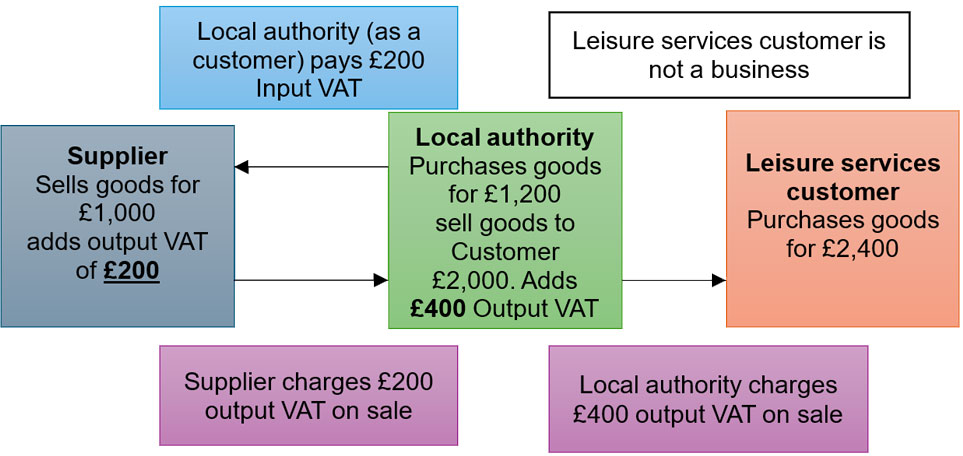

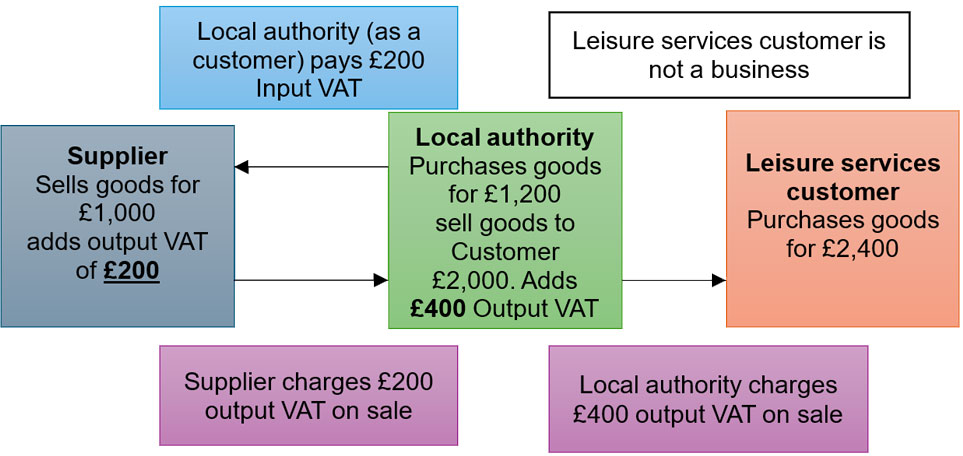

The following example shows how this works:

Previously, the local authority would report to HMRC:

- Receipt of output tax of £400 (from the leisure services customer);

- Payment of input tax of £200 (to the supplier)

The local authority, therefore, pays HMRC £200 (£400 received, less £200 paid).

Delivery model and the impact of the VAT change

Local Authorities deliver leisure services through a range of models, including direct provision, not-for-profit structures (e.g. charitable trusts), and for-profit leisure management contracts.

Where services are provided directly by a local authority, the new VAT treatment can be applied now.

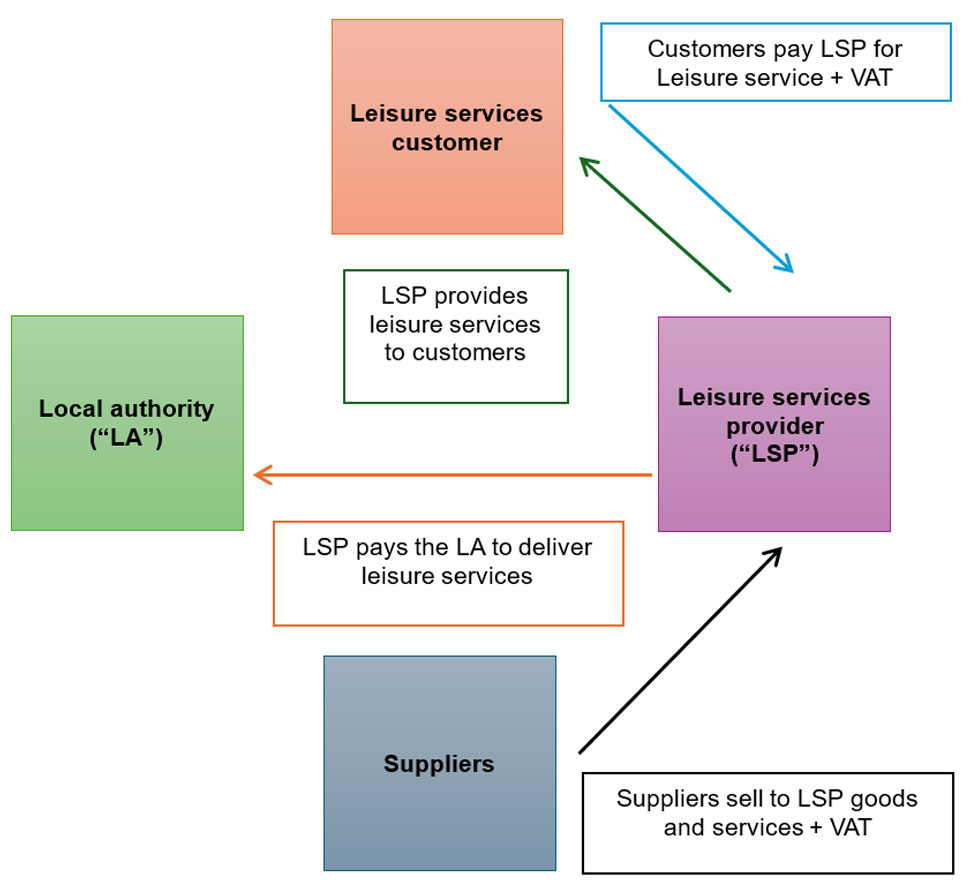

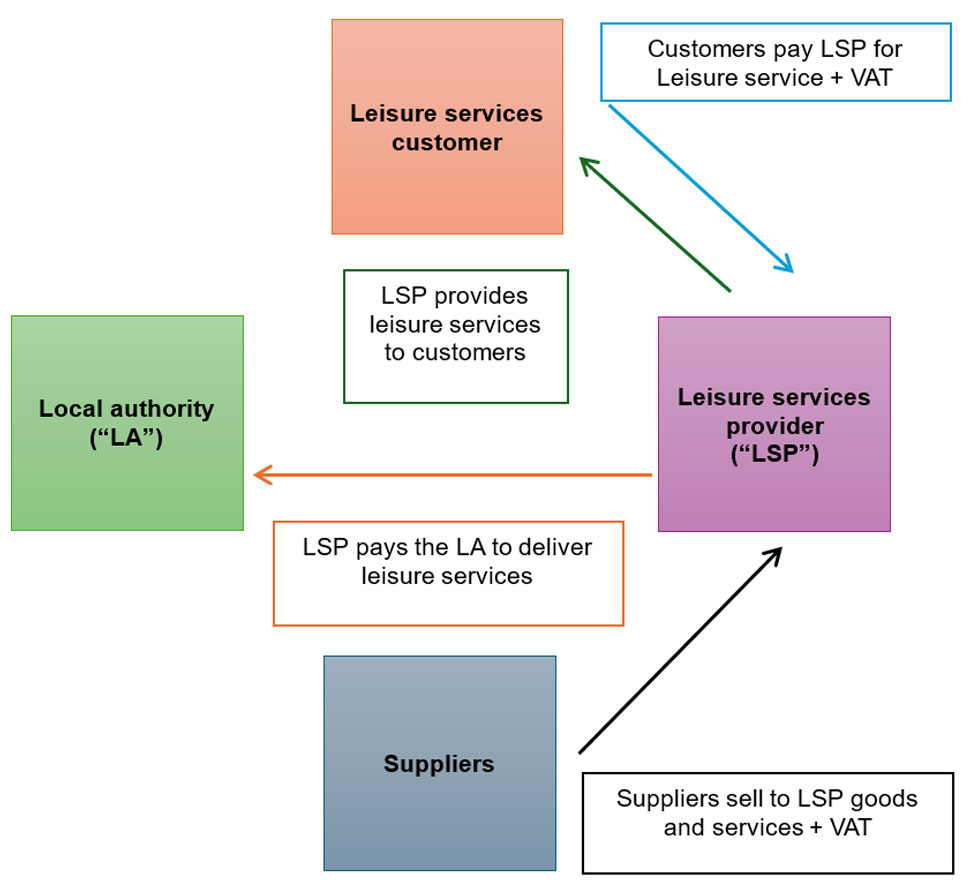

However, where an external leisure services provider (LSP) delivers the services under an outsourcing arrangement, neither the local authority nor the LSP benefits from the non-business VAT treatment.

Standard outsourcing model

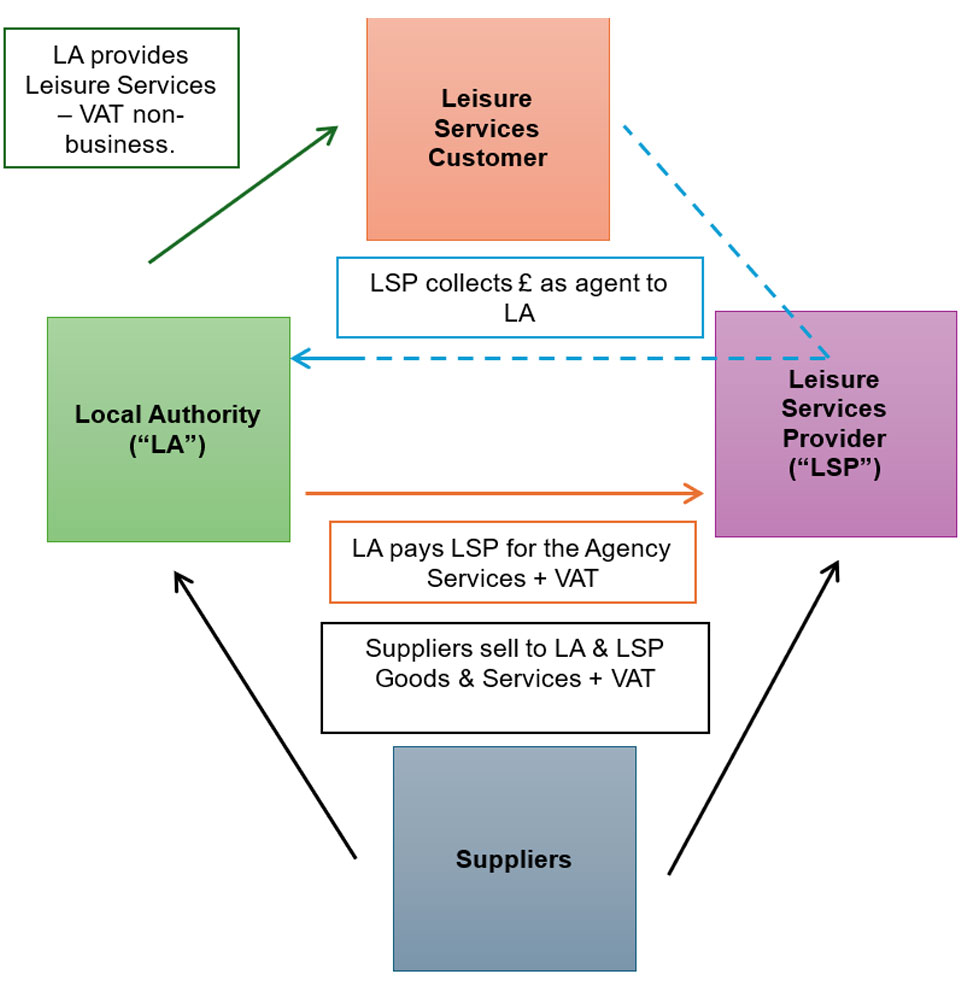

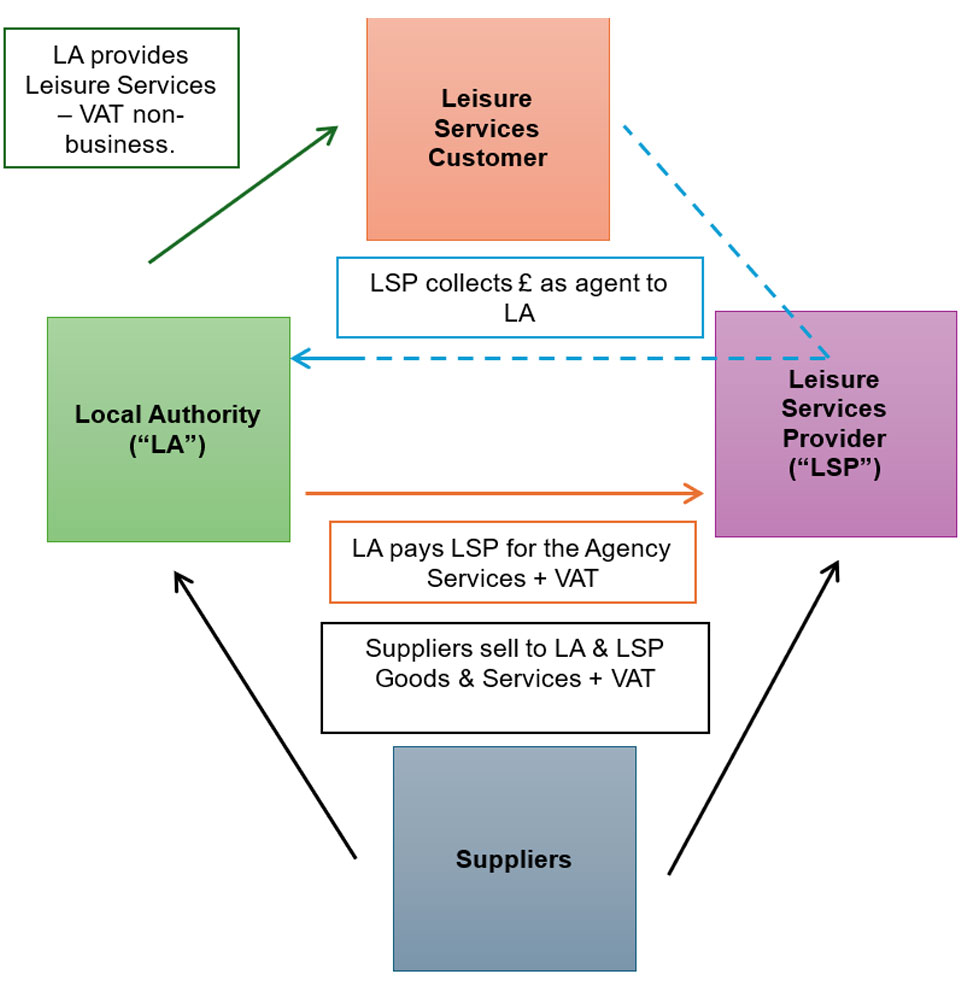

Agency Model

Under the Agency Model, the local authority appoints the LSP as its agent to provide leisure services on the local authorities’ behalf. The LSP collects income from service users and remits it to the local authority.

The local authority pays the LSP for agency services (plus VAT on those agency services), and the local authority recovers VAT it incurs on supplies to it, including from the LSP and other suppliers, while the leisure services to the public are treated as non-business by the local authority.

HMRC has previously acknowledged agency arrangements in the provision of leisure services, including in a 2007 memorandum of understanding concerning contracted out leisure-services[2].

Implementation considerations and risk

To secure the intended VAT treatment, the arrangements must operate as a genuine agency in both form and substance

- Contractual clarity: The contract should clearly identify the authority as principal and the LSP as agent for the supply of leisure services to customers, and allocate rights, responsibilities and risks consistently with that position.

- Operational alignment: Day-to-day practice must match the contractual agency, including branding and marketing in the authority’s name, income collection on trust or equivalent mechanisms, reporting, and segregation of funds. HMRC has indicated particular vigilance where existing arrangements are re-badged without substantive operational change.

- Procurement compliance: Modifications to existing contracts must be lawful under the applicable procurement regime, whether the Procurement Act 2023, the Public Contracts Regulations 2015, the Concession Contracts Regulations 2016 or the Public Contracts Regulations 2006, depending on how the original contract was procured.

- Business rates: The agency model is typically inconsistent with granting a lease or significant property interest to the LSP. This may remove access to mandatory and discretionary rates reliefs historically available to charitable operators. Authorities cannot claim charitable relief and non-charitable LSPs cannot obtain charitable relief; property and rating arrangements will need to be carefully structured.

Next steps

Local authorities considering a move to an agency model should assess VAT, operational and procurement implications in parallel, undertake a gap analysis of current outsourcing arrangements against a compliant agency structure, and plan for transition steps to ensure that contractual drafting and actual delivery are fully aligned.

Independent VAT and wider tax advice should be taken alongside legal advice before implementing this structure.

If you would like to discuss how the agency model could apply to your leisure portfolio, or require support with procurement or contract restructuring, please get in touch.

This article is for general awareness only and does not constitute legal or professional advice. The law may have changed since this page was first published. If you would like further advice and assistance in relation to any of the issues raised in this article, please contact us today by telephone or email enquiries@sharpepritchard.co.uk.

[1] VAT — business and non-business activities – GOV.UK

[2] VATGPB8520 – Other local authority activities: contracted out leisure services: memorandum of understanding paragraphs 1 & 2 – HMRC internal manual – GOV.UK